Take advantage of Section 179 - up to $1 million limit for 2018

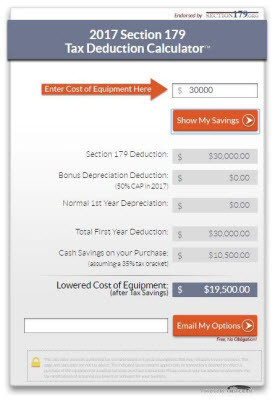

| Upgrading your business' technology can be costly. But in order to keep up with your competitors and stay ahead in the marketplace, it's a necessity. The good news is that by buying smart, you can get a chunk of that money back and Duncan-Parnell is here to help, from geospatial equipment to wide-format printers to 3D printers to Autodesk solutions. Section 179 is a tax deduction available to businesses that allows you to recoup some of the money spent specifically on technology and capital equipment. In 2015, Congress passed the PATH Act, increasing the limit to $500,000. By writing off the full amount paid for any qualifying technology, you can significantly lower the cost to your business. Well, for 2018, that limit has been increased to $1 million dollars!

Question? Contact us at [email protected] As with all tax related matters, you should consult with your tax professional for complete details and eligibility requirements. See the Section 179.org calculator below for an example. |